CRYPTO FAQ (Frequently Asked Questions)

Many or most of the people in the crypto and technology world know about the existence of Shiba Inu (SHIB). This cryptocurrency had quite unexpected price growth that even though it did not reach a cent on the dollar, many people made money with it.

As we currently know, we are going through a difficult time for cryptocurrencies, due to the Bitcoin crash and the lack of confidence in projects as none of them are really stable.

But Shiba Inu might find a small “lifeline” that could give the currency a boost and keep it afloat. We are talking about its new blockchain Shibarium, a solution that will allow this token to have a greater “utility”.

¿What is Shibarium?

Shibarium will be the new and independent blockchain, which will allow SHIB users to make transactions at a lower cost as currently, the SHIB blockchain belongs on the Ethereum network.

All Shib tokens in circulation will be moved to this new network with faster transactions, giving the token a better utility and obtaining a quite interesting investment opportunity.

When will Shibarium be released?

It is common knowledge that it is under development, so most likely later in the year.

This new Shibarium blockchain is generating anticipation among Shiba investors, which is why, once it is launched, it will be very well received by the community.

At The Blue Manakin we like to keep you up to date with news about cryptocurrencies and NFT projects, but as always we like to remind you to be well informed before making an investment and never invest money that we can’t afford to lose.

Cryptocurrencies have become very popular in recent years, this is due to many reasons, but undoubtedly one of the most important has been through famous personalities in the medium that have made the voice of the crypto world.

Crypto influencers are people who through their knowledge have been able to vouch for various projects that in some way have been successful. These people can make a project resonate around the world or remain as an idea that was just executed.

But who are the most influential people? Now we will show the 10 people who resonate the most in this world:

Vitalik Buterin

Co-founder of Ethereum, Bitcoin magazine, and is one of the youngest crypto millionaires in the world.

By following him you can have the latest on crypto and blockchain as he often shares opinions and articles that help more to understand these topics.

Roger Ver

He is one of the first entrepreneurs who started to accept crypto as a form of payment and to adopt blockchain technology and has invested large sums of money in cryptocurrency-related startups.

He is known as “Bitcoin Jesus”, Roger Ver was one of the first promoters of Bitcoin in 2011.

On his feed, we can find the latest updates about bitcoin and the crypto world, with a touch of words of wisdom

Andreas M. Antonopoulos

He is the author of books explaining Bitcoin and the blockchain industry, such as Mastering Bitcoin: Unlocking Digital Currencies, Mastering Ethereum, and The Internet of Money.

He is also known for being an advocate of Bitcoin and blockchain.

Through his posts on his networks, we can learn more in-depth about the bitcoin and blockchain industry, just as he always does in life, and interviews that help educate on this world.

Tim Draper

Known for his forecasts on the price of Bitcoin, as well as his support for this particular digital currency.

He is the founder of the venture capital firm Draper Fisher Jurvetson and Draper University, Tim Draper has invested in Skype, Tesla, SpaceX, Twitter, and Coinbase.

With him, we can find opinions about bitcoin and cryptocurrencies, as well as new coin opportunities.

Charlie Lee

Founder of Litecoin and director of engineering at Coinbase is one of the most trusted sources of information about cryptocurrencies and how they work

He also shares many updates about bitcoin and cryptocurrencies, but he also usually does so by sharing memes and comics with topics related to this world more humorously.

Anthony Pompliano

He is known as one of the pioneering supporters of Bitcoin and is the founder and partner of a hedge fund specializing in blockchain technology and digital assets. He is widely followed on all his channels, not just on Twitter.

He shares discussions about bitcoin and cryptocurrencies, he also likes to talk about technology, business, and finance.

Erik Voorhees

founder and CEO of ShapeShift, one of the world’s leading cryptocurrency exchange platforms

He is one of the most important voices, on Twitter, he always shares his ideas and on the medium, he shares articles talking about bitcoin and other topics.

John McAfee

Ventured into cryptocurrency territory and has taken to Twitter to impart his analysis on the cryptocurrency industry and its multitude of developments.

He is the developer of the famous antivirus and on his Twitter, he shares updates on bitcoin, along with analysis he does on its development.

Tone Vays

He is a financial and blockchain advisor who runs channels on various platforms and social networks

On his networks, he talks about a variety of topics that address Bitcoin, including Bitcoin trading, Bitcoin law, and Bitcoin news. As well as some life lessons on the context of bitcoin and cryptocurrencies.

Ivan on Tech

Content creator specializing in blockchain technology.

In his networks, he shares often with humor, his opinions about cryptocurrencies and Bitcoin and Ethereum updates.

At The blue Manakin, we can help you get in touch with the best influencers to help promote your cryptocurrency project since we have a complete database and we can adjust to what your project and budget need.

Instagram is one of the main social networks that you should manage and have active for your NFT collections.

That is why below we will bring you some strategies that you should follow to have an active and successful account on this social network:

Create a more personalized space:

Unlike Twitter on Instagram, we can share more visual and personal content since through images and stories we can share more about topics such as project development and even fill our posts and stories in the style of the coin or collection.

Post about the team:

Take advantage of the network space to give more visibility to the team in charge of the project and its founders, this helps to raise trust with the collection or crypto project.

Constantly share the mission of the project:

Today with the number of cryptocurrency collections and projects, it is very difficult for us to stand out if we do not have something that makes a difference.

This we can mark it with an objective that aims beyond generating money, so if your collection or project comes backed by a cause, it is here on Instagram where you can take advantage of all the audiovisual content that you can use to share it.

Take advantage of Lives:

One of the best tools Instagram has is its live videos, as they are very easy to use and we can make them at any time.

Take advantage of this tool to make sessions to answer live questions about the project, or use them to share something about the development of the project.

Use hashtags strategically:

It is important to be aware of what are the most popular hashtags on the day, we tend to believe that putting several is enough for our publication to appear in many places, but it is best to be aware every day about what is being talked about the most and use it to our advantage.

Look for experts:

Marketing agencies for crypto and NFT projects are always updated on the best strategies to use on social networks and Instagram is no exception so if you want to highlight your collection on the platform this is one of the best ways.

In The Blue Manakin, we have all the necessary tools to grow your Instagram page, plus we have a database of influencers to use the ones that best suit your project and give it more visibility.

Although the cryptocurrency market had a big collapse a few months ago and many projects ended up disappearing, it was not an impediment for new ones to be born.

Therefore, below we will comment on some of the coins that we consider to have had good growth:

- Tamadoge (TAMA):

This is one of the most novel and interesting projects. Everything revolves around its TAMA token and its roadmap is completely focused on the development of the Metaverse, NFTs and ARs.

TAMA will have a use in its platform to grant rewards to Tamaverse participants. This token is on Ethereum’s ERC-20 network and is characterized by its deflationary nature.

One feature is that for every transaction in the Tamadoge store it will burn 5%.

- Battle Infinity (IBAT):

This project has gained the attention of investors because of the P2E features that make it easy for users to generate interesting profits.

The BEP-20 token native to the Battle Infinity ecosystem, IBAT is what will be used for all transactions within the system and this can be achieved in different ways such as staking or NFT trading, the most prominent way being its unique blockchain-based fantasy sports league in which we can get different rewards.

Battle Infinity has all the looks of being one of the most successful metaverse currencies. And yet another feature is that IBAT holders can also acquire virtual land parcels, which has become a popular investment in the crypto world.

- Lucky Block (LBLOCK):

Given its novel and unique proposition with its crypto gaming platform, its price increased by more than 3,000% in assignment to the pre-sale price, which determined that LBLOCK achieves a market capitalization of more than $750 million.

LBLOCK carries out different sweepstakes in which anyone can participate for only 5 dls, and its attraction is that the more people participate, the better the prizes. In addition, people who have LBLOCK in their wallets and are connected to the platform get a free ticket daily.

Another feature if you have your wallet connected to the platform is that you receive passive income at the end of each draw.

- DeFi Coin (DEFC):

This token supports multiple possibilities for use in financial services, performance farming, cryptocurrency staking, token exchange, and more, making it a very attractive asset for investors.

DEFC incorporates a “static reward” mechanism based on a 10% tax on token transactions, of which 50% is shared among individuals who own one and the remainder is placed in Defi Swap liquidity funds.

- Cardano (ADA):

It is known as the “Internet of blockchains” and is of the most scalable, interoperable, and sustainable currencies of the main networks operating today.

When it came out it had a very large increase reaching 3 dls, then it has fallen but the important thing is how it has remained very stable and in the face of the great fall it was able to maintain itself.

Cardano uses a ‘Proof of Stake (PoS) consensus mechanism that drastically reduces energy expenditure when creating new blocks, which differentiates it from Bitcoin and Ethereum. This gives it an advantage because it makes it the most appreciated by the crypto community and investors.

- Ripple (XRP):

RippleNet is the decentralized payment mechanism that facilitates fast and reduced-cost transactions between different currencies through the use of its Ripple token.

By making use of this system RippleNet has become a de facto upgrade replacing the already very inefficient SWIFT network that accumulates delays of up to five business days in payment processing.

Cryptocurrencies, despite the obstacles that have been put in their way, always find a way to have a step and innovate, these are the cryptocurrencies that we see as something special and that is why we place them on this list.

However, as always we remind you that this is not an investment suggestion and it is up to each person to make their analysis and never invest money that we cannot afford to lose.

Having a large and active community is one of the most important things to having a cryptocurrency or NFT project because this can be a good sign of a prosperous future in the project which can bring more investors or people who are going to buy our collection.

In marketing, it is said that one of the best techniques to promote something is through the mouth of the people, if people speak well of your project that will attract more people because there is something good there.

That’s why we bring you some tips so you can make your community bigger:

- Create a space where your community can live together:

One of the first steps we must do is to have a space where we can receive people who will be part of our community, these spaces are usually different depending on what your project is focused on.

If it is an NFT project the best is to create a Discord server, here you can create different types of channels to entertain your community and keep it informed about the project.

In the case of cryptocurrencies, it is best to have a telegram group, as these are usually more serious so the means of communication must change and the telegram is the space that best suits this.

- Social networks:

Now that we already have a space where our community can stay, the next thing is to have our social networks always active, sharing information about our project and its status.

In the same way, if we have an NFT collection it is best to have some networks so to speak, more colorful and cheerful, we can adopt the identity of our project and by that means share it.

With a cryptocurrency project, it is best to keep the social networks a little more serious, in which we can share project updates, some important data as “facts” about the problems we seek to solve, and something important is that social networks are like a space that we can use as a customer service.

We must not forget to try that in most posts we make, we leave links to our server or group.

- Use your mission to create a story:

The reality is that there are already thousands and thousands of NFT collections and cryptocurrency projects, so it is important to find a way in which our project can thrive.

We have to find a problem that we want to solve and with that base, we can develop the best way to share it through a story, an image, and above all a community.

The people who join the community will not do it just to make money, but for what it means to be in your project and not just to be there but to be part of it.

This will get them to share the project as if it were their own.

- Moderators:

There must be always a person who knows the project active in the group or server, and also helps to maintain order within it,

For this, we will use the moderators who will be the people who will be on the server while the creators are not there and what they will do is keep the conversation alive on the server, when someone asks a question also solve it and when people arrive to put disorder they maintain it.

- Reward your community:

There are thousands of dynamics that we can do in our groups to be able to give things to our community and see a way that the creators have to thank them.

This can be done through airdrops or by giving away a space for the WL or even an NFT.

We can also take advantage of it for our social networks and that way grow the community even more.

- Make special events:

You can make different events for your community, such as a space to share ideas with your followers, and make games inside your server to have a fun time but the important thing is to generate a connection with the community.

- Collaborations with other communities:

Something we always like to mention is that in the end, it doesn’t matter what your cryptocurrency collection or project is about, in the end, we are all looking for the same thing which is to achieve a decentralized financial society.

Look for communities that are open to collaboration so together you can grow your communities with more people looking for the same thing and thinking alike.

- Get experts:

Our biggest recommendation is to find people who know how to move through this medium well. A crypto project marketing agency is one of the best ways to grow our community since a good agency already has its moderators and can manage your social networks and make the copies that best suit your project.

At The Blue Manakin, we have the tools to help you grow your community, contact us for a quote. We have network moderation and both Discord and Telegram servers and we adjust to what your project needs.

In the crypto community, you can be categorized as a type of animal depending on the amount you have of a cryptocurrency in your wallet. Being the whale for those who have the largest amounts, or on the contrary a small shrimp if you have less than 0.5. But in between, there are more animals.

Each one is used to mark trends or movements in the prices of Bitcoins and altcoins.

Below go some of the most common ones:

- Whales:

These are the wallets with the largest number of cryptocurrencies, these users can move significant sums of money in cryptos and cause variations in the market.

They are known as Whales because of the representation that we are all investors in a big ocean, where there are fish (all those who have cryptos) and whales (big investors). Usually, these have a minimum of 1000 BTC.

- Bears:

We will associate this animal with the bear market, which usually hibernates when it is cold and food is scarce.

In cryptocurrencies, this winter is when prices are low, an example is a current market in which we had a big fall.

Normally we associate the price drop of an asset with the action of bears on the market, which many times act influenced by external events.

- Bulls:

When the fear of investing in the cryptocurrency market subsides and people start investing again, that’s when the bulls arrive.

Since the Bull figure is associated with the bull market because of the upward angle its body has with its head raised above its neck.

Bulls can tangibly encourage the prices of any asset.

In the crypto world, we are all an animal but it is up to each person to choose which of these we want to be based on our investor profile or the opportunities we can take. But the important thing is that we all start as shrimp so there is no need to be afraid to take that first big step into this world.

At The Blue Manakin, we want to help you on your journey in the world of cryptocurrencies and NFTs so don’t forget to check out our blog posts where we talk about different topics about this world and the latest trends.

Although their name may have the word “coin” in it, cryptocurrencies are not considered real money, since they seek to separate themselves from their fiduciary counterpart.

Another characteristic of cryptocurrencies is that their value depends on their acceptance and the movements they have in the market.

Finally, it is digital money and it is stored digitally, so its regulations are also different in each country since they do not have a financial system that regulates bitcoin or these currencies, and even in some places, they have been considered illegal.

How are cryptocurrencies taxed?

This can be somewhat complicated to comment on since, as mentioned above, each country manifests them in different ways. If one thing is certain is that the purpose of cryptocurrencies is to be decentralized so as long as they remain in your digital wallet and through equally digital payments they do not present a real problem for taxpayers.

But this is different when we talk about withdrawals in the real world, many exchanges allow you to withdraw your cryptocurrencies to real currencies such as the dollar or the euro, so if one day you find yourself in the need to make a withdrawal, if it is very large it will be quite sure that you will have to find a way to declare it.

Many sites help you keep a record of your buying and selling transactions that can help you in case you are asked to make a declaration one day.

What can I buy with cryptocurrencies?

Nowadays it is easier to find things that can be paid for with cryptocurrencies we have a blog that talks about what we can buy with bitcoin, but below we leave a list of things you can buy with cryptocurrencies.

- Electronic products.

- Software services.

- Video games and entertainment.

- Flights and tourist experiences.

- Gift cards.

- Charitable causes.

- Restaurants

Conclusion:

It is clear to us that cryptocurrencies are not currencies or money that are related to the typical economies of the world

Some currencies like bitcoin have a behavior more like trading and when the major shareholders decide to withdraw from this market will be an imminent collapse, so it is important to be aware of the market and never invest what we can not afford to lose.

And finally, we can already use these non-real coins to buy real things and also to make withdrawals but it is important to keep in mind the regulations of our countries to not commit illegal things.

In the world of cryptocurrencies, various scales have become popular, in which most use different animals to pigeonhole the many investor profiles.

The largest investors in digital currencies are known as “whales” It is customary to call such players with a minimum of 1,000 BTC.

Several of them are known, such as Pantera Capital or Coin Capital Partners, even if other influential addresses are not known.

It is complicated to know to whom the addresses belong or whom the entities hold the largest portions of Bitcoin. However, reports provided by analysts and professionals allow speculation as to who might qualify for this set of giant fish.

So a whale is an actor that trades vastly more money than the average investor so they possess the power to manipulate it up or down.

As an example, when whales begin to hold their bitcoins for extended periods, it indicates a good future for the cryptocurrency and there is speculation of a rise in its cost. The opposite may also happen. Once whales massively sell an asset, other smaller investors tend to continue the trend, and consequently, it can cause a drop in the cost of the currency.

Not only can monumental organizations be known as whales, but some have speculated that there are individual investors, popularly known in the crypto world. One example is Satoshi Nakamoto, who is the first to mine and hold this asset and is believed to have around 1 million bitcoins.

Other known investors who could receive the title of whales are the Winklevoss twins, who in 2013 mentioned having 1% of all Bitcoin and who could currently collect more than that.

The whales as a group have not diminished, but they have increased, so they will continue to accumulate large amounts of bitcoin and act as holders for a great period more.

Other denominations to know are as follows:

- Shrimp: less than 1 BTC

- Crab: between 1 and 10

- Octopus: 10-50

- Fish: 50-100

- Dolphin: 100-500

- Shark: 500-1,000

- Whale 1,000-5,000

- Humpback whale: more than 5,000 bitcoins

Many times while navigating this immense world, we may come across terminology that we don’t know or fail to understand so here at The Blue Manakin we will do our best to help you understand this vocabulary in the crypto world.

As time goes by and in this last year, we see more and more the use of cryptocurrencies in a more everyday way. Even so, we still have some inconveniences when using them to buy things since not all businesses accept them as a payment method, or there is no way to use them daily when going to a coffee shop or when we go to the supermarket, that is why tasting how to convert into fiat money to use it in physical stores or simply to have cash is important and many people can see it as something complicated.

It all depends on the country and the currency we are going to use, Bitcoin is still the most used cryptocurrency so in it we can find more facilities to change them in certain countries and there are more methods to change this into cash.

How to exchange it for real money?

The first thing we recommend is that you look for the conversion of your cryptocurrency to real money, you can do this by searching directly on google in some cryptocurrency exchange, it is only to have an approximate as this value is constantly changing.

The easiest way to convert cryptocurrencies to fiat currencies is through exchanges, where you can find different alternatives to exchange them such as:

1. Using the platform’s withdrawals.

When you have an exchange wallet, you will only have to request an order to sell your Fiat coins, usually, we can find a withdrawal section to do this.

You just have to wait for it to be executed and the real money will appear in your wallet. Then you will be able to withdraw it to a bank account.

2. Use the P2P method

In most exchanges, or at least in the most popular ones, there is an option to buy and sell cryptocurrencies using the P2P method. With this method a person who wants to buy cryptocurrencies will do it directly with you, depositing the money in the currency you want to your bank account.

3. Automatic Teller Machines.

In some parts of the world, it is already possible to find ATMs that have the possibility of reiterating money from wallets, specifically those that have bitcoin and it is as simple as scanning a QR code with your wallet to make the withdrawal.

4. The bitcoin debit card

We have talked about this card before on this blog. Not long ago we talked about this Visa card that allows you in many establishments to pay in a normal way using bitcoin.

Are these transactions taxed?

It all depends mainly on the regulations that exist in your country if money enters your account, it must have come out of a legal space and you will have to declare where it has come from.

We invite you, depending on the country you are in, to investigate the way to declare your earnings made with cryptocurrencies and the taxes you would have to pay for them, all this so you don’t get into trouble.

We hope this post has helped you a little more in your way through the crypto world, knowing some of the ways you have to get a real payment for your cryptocurrencies and also about the tax obligations you may have with this.

A crypto influencer agency works in the same way as a celebrity agency; it is a group of influencers that have the same manager, who is in charge of scheduling the promotional posts. To find the best influencers agency you can start by searching influencers and if they have an agency they´ll redirect you to it. This way you ensure the agency has accounts that you may like.

Every promoter can offer a different price and services, but if you work with an agency, you can hire a package that includes all the influencers at once. At the Blue Manakin, we sometimes use this strategy to do massive promotion campaigns.

There are different factors that affect a Crypto influencers´ price. The main factor is the engagement that the user has on his account. Promoters with lower engagement usually cost around 300-400 USD per promotion, but the influencers/promoters with bigger engagement can cost a lot more just for one promotion like a retweet or a pinned post. Before you buy a service that might not work the way you want, look at the comments on every post of the account, is it real people commenting? Are these users interested in crypto/NFTs? Are they potential buyers? With these rules, you can have an idea if the price that the promoter offers is worth it.

There is a large community of specialized Crypto influencers on Facebook. To find the right Crypto influencers on Facebook for a cryptocurrency, it is important to first be clear about the goals of the Crypto project, as well as the type of audience a collection is targeting.

Although the Crypto audience is very niche, there is a wide diversity of categories of Defi users online. Locating a Facebook crypto influencer will always require extensive research beforehand, allowing you to make sure which crypto influencer is the most appropriate for your project.

LinkedIn is a particularly appropriate platform for the dissemination and location of investors in new cryptocurrencies as a large percentage of the users most interested in decentralized finance are found on this social platform.

There are thousands of websites all over the internet with lists of the most important crypto influencers on different social platforms. However, the diversity of alternatives is so great that finding the appropriate NFT influencers on LinkedIn for a cryptocurrency requires a deep analysis aligned to the launch strategy of a Crypto project

At the Blue Manakin, we have an extensive directory of Crypto influencers for LinkedIn and other social platforms.

Every promoter/influencer has its services and some of them have packages for big promotions. The most common promotions that the promoters offer are giveaways, retweets, and pinned posts, but some of them might also include in their services things like changing the profile picture of their account, shilling the project in another platform, or being like an ambassador of the project. Of course, you have to be careful with scams, if a promoter has 100,000 followers and only 500 likes and retweets in their posts, the most common thing is that the account is fake.

To choose the best Crypto Marketing Agency you need to do your research and make sure your goals and values align with theirs. Obviously, you need to see their services team (make sure they are not scams), types of projects, collaborations, launches, and results. What worked for another crypto project may not be the best strategy for yours. The best agencies will customize your strategy and make sure that everything possible is done for a successful launch and outcome.

This is the situation of cryptocurrencies, a form of payment that almost no one is unfamiliar with, but which was not yet fully regulated. For this reason, the National Securities Market Commission (CNMV) has decided to regulate the advertising of cryptocurrencies once they are shown as an investment object.

Cryptocurrencies with the financial system

The advertising of cryptocurrencies goes in that the more understanding by the greater part of the population the greater the provocation for various banking entities or organizations to encourage their users to invest in cryptocurrencies.

The CNMV estimates that in several of the campaigns the client is invited to invest in a product about which he has hardly any information or knowledge of its dangers. Thus, cryptocurrency advertising will have to use clear and simple language so that users can understand the message clearly, impartially, and with no intention of lying to them.

What should cryptocurrency advertising be like?

First of all, you should avoid referring to the profitability that can be obtained with your investment. And, in case of doing so, it will be essential to indicate a specific return time, which cannot be less than one year.

It will be essential to make it quite clear which product is being advertised, thus avoiding confusion with other more famous ones, such as Bitcoin. Likewise, it will be essential to indicate the entity responsible, the territory in which they will be stored and the legal framework to be used in that case.

What are the problems with cryptocurrencies?

For the CNMV, crypto-assets are a high-risk investment product.

Regarding stability, it is estimated that the process could be susceptible to attacks that attempt to change the data in the chain; although in this sense, varying a blockchain (or blockchain) could be somewhat difficult for the practical integrity of users. But, should they be able to circumvent the process, users could lose all of their crypto assets.

Conclusion:

Every day we see that many companies are starting to join the world of cryptocurrencies and NFT, these new projects come with different advertising campaigns. But it is important to be careful and before getting fully involved with the project, we must be fully informed of what is going on and as always never put money that we can not afford to lose.

What does it mean to mine cryptocurrencies?

This answer encompasses many myths on the subject of cryptocurrency mining. Mining cryptocurrencies is not creating them out of thin air or forging them with special programs, cryptocurrency mining refers to a set of processes necessary to validate, process, and confirm transactions of a cryptocurrency.

In the case of bitcoin, mining consists of validating and recording transactions on a blockchain. For this, all the nodes of the network (the computers) participate in the successful resolution of the riddle that involves the search for the block, taking into account a random number and with the application of a cryptographic function, a hash is found as a result, which complies with a characteristic, which always has a certain number of characters.

What is needed?

This work requires effort and computational power, which ensures how complex it is to write new transaction blocks to the registry and thus prevent an attacker from generating a fake block and adding it to the blockchain affecting already existing blocks.

Do all mine work the same way?

Not all cryptocurrencies work in the same way, so the way they mine depends on the system that uses the blockchain or algorithm of each cryptocurrency. However, one thing they all have in common is that there are never any useless operations between miners, but rather they are necessary to maintain the stability and security of the network being used.

Since the miners’ work is so important they charge an amount of money for their mining work. In the case of bitcoin when a miner finds a valid block he is rewarded, since February 2021 for each new block a miner earns 6.25 bitcoins. The payment is made with coins that are in reserve and at that moment they enter into circulation, so it is erroneously believed that cryptocurrency mining consists of creating new coins.

The coins are already previously defined, however, the job of mining is to bring more coins into circulation.

According to an analysis by Cambridge University’s Centre for Alternative Finance (CCAF), if bitcoin were a country, it would consume more electricity per year than Finland, Switzerland or Argentina.

This is because the process of “mining” the cryptocurrency (using gigantic computers that never stop working) consumes a lot of energy.

The machines dedicated to “mine” or extract bitcoins are specialized computers that connect to the cryptocurrency network. Their job is to verify transactions made by people sending or receiving a currency, in a process that involves solving many mathematical puzzles.

Usually the reward for that work is low and only small amounts of money are obtained in comparison to all that is spent in order to obtain them. That is why the only way for mining to be a profitable process is to do it on a large scale, with huge energy consumption and computers working 24 hours a day every day.

That is why illegal cryptocurrency farms are installed in cities where electric power is cheap. They also seek to be in cities with frigid climates because the heat produced by the computers would make the cost of an air-conditioned area very expensive, thus cooling the equipment quickly and more cheaply.

One might think that with the advances that we have today with respect to renewable energy could solve this problem, and although it is a part of the possible solution that can be given, there is still much energy that is produced from fossil fuels such as gas, oil and coal, which are highly polluting and produce a very large carbon footprint.

Promoting new Cryptocurrencies on video platforms is one of the most impactful tactics for the community interested in investing in Defi. Finding Crypto influencers on YouTube is a complex task, due to the huge amount of YouTube channels that exist dedicated to different utilities of blockchain technology. At the Blue Manakin, our catalog of YouTube Influencers along with our knowledge about the most effective Crypto influencers for your launch is at your service.

“There are two ways to find Crypto influencers. The first one is looking for relevant hashtags: #CRYPTO #COIN #BLOCKCHAIN #OPENSEA are some of the hashtags that might help you in your search. It is easy to identify a relevant promoter because of the content that they post. It will usually consist of a lot of giveaways and posts about different crypto projects, also, some of these promoters will have their contact in their bio.

Twitter has most of the crypto promoters and a lot of crypto projects start with one tweet and a few retweets from a good promoter with good engagement. The second way to look for promoters is to look at other projects and search in their content for reposts of promoters. If you are looking in a collection that sold out and you see that the account has a retweet from a promoter that shilled the project, the most probably thing is that that promoter has good engagement and could be very useful, the same thing works with micro-influencers.

Nevertheless, it is always important to look in the comments for fake users. If a promoter has a lot of likes in their post and very few comments, or has a lot of comments from questionable accounts, the most common thing is that the promoter is fake. “

We know that there are currently thousands of cryptocurrencies and that more and more are appearing.

Normally new coins can be found in their first phase in the form of ICOs, which is the process in which the creators can somehow raise funds to develop the rest of the project. This is basically when the first investors come to the project.

NFTs can also be found when they are still in pre-sale or on a whitelist.

The advantage of being able to find these projects during these stages is that we can find them at much cheaper prices than they will be in the final sale.

So we will share some ways to be able to find these projects before their public sale:

- Content creators:

It is important to follow the creators of the topics that we like or that we are usually aware of, that is why if we want to find projects that are just about to come out, we have to follow the people who are dedicated to talking about it.

Usually, new projects hire people to do promotions for them which still adds confidence to the project.

- Calendars:

We can find on the web different pages that are dedicated to calendarizing the releases of new coins and NFT collections. In them, apart from seeing the release date, we can also find information about the project.

- Spooling platforms:

Several platforms are dedicated to finding new collections and ICOS and creating lists, as for the NFT others can even give a rarity to your NFT depending on their characteristics.

- Telegram groups and Discord servers:

On these platforms, we can be part of communities that are always on the lookout for these new exits and opportunities so by being part of them we can equally find these opportunities before they come out or when they are in their early stages.

- Crypto marketing agencies:

Serious projects usually have a team or agency that is dedicated to their marketing, so following the agency is an opportunity to learn about new projects that are about to come out.

In The Blue Manakin, we always have projects which always have a mission or art that we like, so if you always want to find projects that are coming out and are of quality follow us, so you do not miss them.

Cryptocurrency projects, as we have discussed in several posts in this blog, need the best marketing strategies to stand out in this world where new projects with different types of proposals are launched every day.

That is why we will discuss some of the strategies that we believe could help us to grow our project this year.

- The planning and execution of the marketing campaign:

Any good plan for a successful launch of our cryptocurrency project must be prepared well in advance to reduce as much as possible the number of errors and problems that may arise with the launch of our token.

For this reason, we recommend starting between 4 and 6 months before the date of the public sale of the token.

The first thing to do to be successful in cryptocurrency marketing is to establish tools for tracking and measuring the results of the campaign. These include:

- Google Analytics and ADS.

Running google ADS is something that can bring quite a few people to the project, nowadays it is more normal to stumble upon a cryptocurrency exchange or crypto project while surfing the internet or while watching a YT video.

Hand in hand with ADS, there is Google Analytics with whom we can measure the data and results of the campaigns we do as well as the traffic generated.

- Management and content of social networks

There are different social networks so the strategy to follow varies depending on the ones we are going to use, the same as the content that we will upload to this has to be different, normally if we talk about a cryptocurrency this is usually more serious, but this can also be different for example talking about one that is part of the metaverse.

Below are the networks that we recommend along with the strategy that we think:

- Twitter:

Twitter is usually one of the main means with which people are going to know about your project, so here what we will be looking for is to share the most relevant data as well as updates on the project, twitter should be the first place where we warn.

The language we use varies with the project, but usually, if it is a cryptocurrency one we will use a more serious language unlike if it is an NFT one where there is usually more partying.

- Telegram:

This social network is where we will have our community, it is the place where we will talk directly with users interested in our project and keep up to date with everything.

- Instagram:

On Instagram, we will have a more personal approach, in which we can publish more about the mission and objectives we have with the project. Same here we will share a lot about events we attend to promote our project, as well as we can do live Q&A events and meet the founders.

- Community building

They say that the best marketing is word of mouth, so building a community that is interested and loves your project is one of the most important tasks to have.

For this, we have to always keep them interested in an environment that feels like family and belonging. It also serves to reward the community, this can be through giveaways, airdrops, and different activities that end up giving something to the people who participate the most in our project.

In the end, they give life to the project and the people who arrive and see an active community, it is quite certain that they will stay.

- influencers

Influencers are the people who can move our community in quite significant ways, of course as long as they are good, so it is important to look for them not only by the number of followers they have but also by the interactions they manage to have.

The advantage of these influencers is that with a single story, a video, or in general any good collaboration achieved with them, many people will reach our project.

- Collaborations with other projects.

Another of the best ways to make our project grow is through collaborations with other projects, since this generates trust, especially if the project with which we collaborate is already at an advanced stage and has a strong and reliable community.

- Newsletter

It is important to have a newsletter because this way we give priority to a more intimate and private channel with our clients and community, with which we can share accurate information about the status of the project or the things that have been achieved. This helps to build trust and connection, especially since in this space what we are looking for is to get large investors for the project and its future.

Conclusion

Depending on the focus of our project, some strategies might work more than others as each cryptocurrency community is different. The important thing is to always keep clear about what our goal is and use it most naturally and organically in our content.

In The Blue Manakin, we support you to make the marketing strategy that best suits your project because we have experts who are both aware of the market trend. contact us

In the world of cryptocurrencies, an ICO is the initial offering to the public of an asset and, in this case, a crypto asset. The characteristic of this stage is that we can find the price of the token very low which is usually a good investment opportunity for many people.

Now we will share some steps with which we can launch our own ICO:

Step 1: Have an idea

Many currencies focus on small industries, creating blockchain solutions in preparation for Web 3.0, in others are simply looking to be a currency for others to invest in and trade.

So the first thing is to find out what it is we want to work on or the problem we want to solve.

Step 2: Assemble a project team

Assembling a team allows you to consult with people who are likely to be experts in many of the regions where you need information.

A strong team is a team that is prepared for all the adversities that may come in the stages ahead.

Step 3: Write a whitepaper

A whitepaper should state the currency’s problem, if any, and how it will solve the problem.

This is the book that will contain all the complete project information, this will be the first thing that serious investors will look for.

Step 4: Capable contracts

We have to generate our smart contract, in the base blockchain or open source that we will use, if you don’t taste how to do this in The Blue Manakin we can support you.

Step 5: Select a sales model for your coin.

Which one you choose may depend on several elements, including the location of your headquarters (as different countries have different rules about ICOs).

- Fixed-rate offering (Uncapped)

It will remain at a fixed price for a certain amount of time, from which time customers of the token will buy it at the market rate.

- Soft cap

The token creator institutes the minimum fundraising amount of the ICO and sets the price accordingly.

- Hard cap

The token creator sets the maximum amount of elementary capital.

- Hidden cap

Would keep key details secret until the public needs to taste them.

- Dutch auction

The price of a coin starts with the highest sale price.

- Reverse Dutch auction

There are a limited number of tokens and the number of tokens sold each day is divided equally over the duration of the ICO.

- Collect and return

There is a fixed price, but customers can bid above this fixed price.

- Dynamic cap

This prevents major investors from taking control of a large number of coins and gives smaller investors a chance.

Step 6: Market your ICO and coin

Before launching an ICO, the project must have significant interest for investors to buy a new coin.

Step 7: Finally, launch your ICO

To launch your ICO, apply to exchanges such as Coinbase, and Binance which are the most popular to integrate your ICO, but there are many more, the important thing is that it is a known exchange to raise the confidence of investors.

Conclusion

ICOs are the first side of our project so it is important to make sure you move forward with a good action plan, providing potential investors with the information they need and performperforming general due diligence.

At The Blue Manakin, we support you to create a whole strategy for your ICO to have the most successful launch possible, consult with us.

Initially, generating a cryptocurrency was quite difficult to do. However, currently, there are different platforms and projects that allow us to produce cryptocurrencies quite easily, we can even count on companies in charge of marketing crypto projects that can help us with this.

We comment on the steps to know how to produce a cryptocurrency:

1. Consensus algorithm

In Blockchain this algorithm is the mechanism used to choose the convenient state of a record after making a transaction. In this way, this becomes the truth that all nodes must follow.

2. Blockchain network

An important choice is the blockchain network that we will use for your trading. Some of the most prominent platforms are:

- Ethereum

- Quórum

- Corda

- IOTA

- Cardano

3. Nodes

Here we have to decide how the blockchain is going to work and design, will the permissions be private or public? Will the hosting be in the cloud, on premises, or both? What will be the hardware details needed to run?

4. Blockchain backend

Here we will have to have ready the way of how things are designed, such as the address format that your blockchain will follow to exchange between different cryptocurrencies without an external intermediary.

5. APIs

Some platforms don’t provide predefined APIs, so make sure you have your own.

6. Interface

You must ensure that the web, FTP servers and external databases are the most current and that the front-end and back-end programming is done with future updates in mind.

7. Legal project

Before launching the project, we must be sure that our cryptocurrency is prepared and complies with the laws that will quickly become the regulations of the entire cryptocurrency world.

Conclusion

We hope that these steps will help you to understand in a very simplified way the way in which you can create a cryptocurrency, if you need more help, do not hesitate to contact us to help you make your cryptocurrency project a reality.

In August 2021 its financial products and services policy was updated by Google. This update clarified the scope and requirements for cryptocurrency advertising in Google Ads.

To qualify for Google’s certification, the following characteristics had to be met:

- Be legally registered as a money services company.

- Comply with the legal requirements of the country or region.

- Ensure that both ads and landing pages comply with Google Ads policies

Things you can’t do even if you are certified:

- Initial currency bidding ads.

- Trading protocols

- Promotion of cryptocurrency sales or related products.

- Advertisements of comparators or with the issuance of cryptocurrencies.

Both if we want to advertise our project through Google ADS we have to fill out an application to advertise cryptocurrencies that can be found on the Google website.

If all the above mentioned above about certification is not fulfilled, any advertisement related to cryptocurrencies will be removed from Google results.

Other social networks:

After having banned all cryptocurrency-related ads to prevent its users from falling for scams, since 2019, Facebook has been working on relaxing its restrictions on blockchain and cryptocurrency-related ads.

Facebook has encouraged companies operating on such platforms to support their activities on social networks. Currently, you can use Facebook to advertise your crypto products and brand.

Conclusion

To be able to advertise through ADS we must meet all the requirements in order, here at The Blue Manakin we support you with everything you need to create a complete and effective marketing strategy with which you can meet all your goals to publicize your cryptocurrency project.

Currently when we talk about cryptocurrencies there’s already a wide variety of options to generate money with them without spending a lot of time, as with trading.

For these ways, it is enough to know what are the market options that provide passive income and choose the one that we like or are most interested in.

What are passive incomes?

Passive income is a way to make money on a regular basis without having to devote a lot of your attention to it.

In other words, they are produced by themselves through an initial investment and there it ends. Basically, instead of the savings being stagnant, it just increases

With cryptocurrencies, there is a wide variety of investment options that generate passive income for experts and beginners alike.

Let trading work for you

Trading is definitely the most well-known way to trade and generate income with cryptocurrencies. The point is that the ones that really generate short-term income through trading are the ones that are aware of currency movements 24 hours a day.

There are some platforms that allow you to set automatic values of which when it drops to a certain amount it is bought automatically and when it reaches a high value it is sold in the same way. So this way trading is done for you.

Stacking of your cryptocurrencies

Staking through proof-of-stake, an activity that allows you to lock up your cryptocurrencies to contribute to the mining process. In exchange for this, you can get rewards.

The blocking time is set at the beginning, either flexible or for a determined fixed term, this can be done with different crypto currencies and variable amounts.

Conclusion:

It is important to remember that all investments are not risk free. That is why we remind you that everyone has to do their complete research before putting money in, above all, never put money that we cannot afford to lose.

The way Reddit works is with forums called subreddits. The community in the subreddit participates by sharing a project, discussing some news, or showing their work. Once you finish reading the post you can decide between giving it an upvote or a downvote, this will make the post go up or down in the subreddit.

In the subreddits, you can find Crypto influencers. The best way to promote crypto on Reddit is to search the subreddit related to the subject and make a striking post to get upvotes. Sometimes to post on a subreddit you are asked for certain age and karma, which you can earn as you participate in the communities, making posts and comments. At the Blue Manakin we have the seniority and karma to promote your projects on the best subreddits.

You can’t promote Crypto on OpenSea, it is a marketplace for buying/selling NFTs. There is no advertising for NFT or Crypto.

Quora is a social network for sharing and answering questions. If you have doubts about something, you really like a subject and want to know more, or you just want to learn new things; Quora is the ideal space and is the next step to what was Yahoo Answers. Quora works very simply and is similar to Reddit, you follow the topics you like and you have a feed. In these, there are hundreds of questions that you can answer and get upvotes and downvotes so that when a user enters the question your answer appears at the beginning or the end. How to promote my crypto project in Quora?

• Search for areas and questions related to the project you have, whether it’s an NFT, an ICO, IDO, or any crypto project.

• Find questions that don’t have many answers, so you can position yourself first without the need to have many upvotes.

• Check the questions that have the most upvotes and leave your answers.

• Create your answers with passion and be forceful.

• Create posts and questions as if you were going to search them on Google, so people who search for them will find them directly. You can also create questions about your project.

At the Blue Manakin, we have the SEO experience to generate questions and answers that will give your project more visibility.

Rarible is a platform for creating, buying and selling NFTs. It is not really a space to promote your NFTs, but nevertheless it is good to have them there since it gives people more security when buying NFTs on a platform. But to promote cryptocurrencies the reality is that it would be useless.

You can use Telegram to do crypto marketing in different ways:

Advertising on other platforms to generate traffic to Telegram and answer FAQs. (Users, shillers, RRSS, Digital Marketing).

• Use promoters or influencers related to the project and mention the Telegram group for more info.

• Doing activities on Telegram, dynamics like airdrops, raffles, giveaways, announcements, or any kind of news related to the project to maintain the hype of the community.

• Looking for the best groups that fit your project and promote it there.

There are different ways to market Crypto and promote your project. You can start thinking about your audience; do you want amateurs or more experienced people? Do you want to target a specific market? And from there, along with your budget and how massive you want your project to be, you can work on the promotion strategy. At the Blue Manakin we know what works and how long it takes to meet the project goals.

Every crypto project that you want to rely on must have a white paper which is a document that includes all the detailed information about what you want to achieve with your project, its architecture, and the interaction with the users.

A whitepaper should contain these points:

- Introduction:

Write an introduction that hooks people to continue reading the rest of the whitepaper, you can start by giving the objective you hope to accomplish to talk about it later, explain the benefits and give an overview of the content that we will find in the whitepaper.

- The team:

Introducing the team is an essential and fundamental part of the white paper, it is the human part inside a document full of technical specifications, you can include photos and small descriptions of the team such as what is their role in the project and their experience within the crypto world.

- Table of Contents:

White Papers are technical documents, so on average they can have from 25 to more pages, so we can place a table with all the contents to touch, so the reader can locate the important topics and even read will the document by the topics that most interest him at the beginning.

- The objective of the project:

This is where we start talking in-depth about the project, so take as many pages as you need to explain what is most important, explaining what the project is and where it is headed.

- How you are going to achieve it:

In this part, you can talk about the prototype data, first users, development strategy, and a bit of the road ahead.

- Tokens:

We will use this part to talk specifically about the tokens that make up the project, the way they work, and what their special features are. In the end, this is the image of the project, it is what people are going to see visually in their wallets so we have to give it a good presentation.

- How the funds raised will be used:

It is necessary to show investor users where their money is going to be going in the early stages of the project so that they have a better notion of the investment they will make for the development of the project.

- The roadmap:

Every good crypto project should present a detailed roadmap for the next 12-24 months, which you can make eye-catching by showing that it has been completed and where along the road the project is going.

- Legal Notice:

Do not forget to place a legal notice or disclaimer, which should contain any important legal restrictions or notices. As certain regulations in countries and in general things help to indicate that in the end we all risk for the project and if it does not go well we all know what we were getting into.

Alternate Modalities to White Papers

Next, we will show additional documents to the white paper which are intended to complement the information found in the White Paper.

One Pager

A document that describes the White Paper in a more summarized form, normally with an extension of one or two pages at the most.

Yellow Paper

When we have complex innovations at a technological level, a yellow paper helps to describe well all these ideas and serves to expose to the investor if the team has the necessary technical capacity to develop the project correctly.

Beige Paper

It is a less technical and complex Yellow Paper for the understanding of all audiences.

As final tips when preparing a White Paper we must use a formal writing style, without spelling mistakes and almost perfect writing is very descriptive and professional. We should review it more than once before publishing it and we also recommend translating it into the most spoken languages so that it can reach more people.

At The Blue Manakin, we help you with your white paper to make it as detailed and eye-catching as possible.

As of now, there is no such thing as an influencer crypto marketplace or influencer crypto platform. The best social media to find crypto influencers is Twitter. On this social media you can see a lot of promotions, giveaways, and shilling from different Crypto and NFT projects, These promoters usually offer other services on other platforms, but Twitter is the crib of crypto promoters at the moment. You can look at websites like Social Blade to find out more about the promoter and to see if it is worth it or it is just another promoter with paid followers.

The year 2009 marked the beginning of the cryptocurrency era, starting with the first of them all, Bitcoin. From that date until today, competitors called altcoins to continue to be added.

To the point that to date there are more than 3000 different types of digital currencies in the market, which offer us different things and it is important to taste which are the most popular types of cryptocurrencies and which are vital to know before investing.

Below, we present the ones that are considered to be the main cryptocurrencies:

- Bitcoin

Bitcoin was created in 2009 by an anonymous personality under the pseudonym Satoshi Nakamoto.

Its main goal was to be used as a payment method that is not affected by government oversight, transfer delays, or transaction fees.

Currently, its use is mainly as a form of investment, but its high volatility prevents it from being a legal alternative to fiat money.

- Ethereum

Its chain enables it to generate applications based on blockchain technology, as well as its tokens.

Ether takes care of granting the primary fuel to process the network’s decentralized applications. And, transaction prices are calculated based on their difficulty, bandwidth, and storage.

It is considered the most important after bitcoin, plus the implementation of smart contracts is what put it here.

In its network is where we can find most of the NFTs.

- Dogecoin

Currently, 128.2 billion DOGE are in transit, and each coin is divided into 100,000,000 decimal places. The virtue of this cryptocurrency is that it is cheap because one coin costs only $0.05037. Dogecoin mining rewards have decreased from $1,000,000 to $10,000.

- Cardano

Every single transaction is persistently, securely, and transparently recorded on the Cardano blockchain. Each ADA stored in the digital wallet can be ordered in the pool or hypothecated to the same pool to increase the possibility of earning rewards.

One of its attractions is that anyone who owns Cardano owns shares in its network, plus this blockchain is considered scientific and one of the most eco-friendly out there.

- Litecoin

The Litecoin virtual currency is an open-source peer-to-peer currency. This means that Litecoin’s source code is public and anyone can access it. It is an open-source, fully decentralized, universal payment network and an administrator-free transaction system.

It is a project that has stood out for its transparency in the function of each of its stages.

Conclusion:

We remind you that in no way this top is this an investment recommendation, it is up to each one to do their research and never invest money that we can not allow ourselves to lose.

This top is to publicize the cryptocurrencies that are considered the most important for what they have brought to this decentralized world and because their projects have stood out.

Web 3.0 is a term used to describe the next generation of the Internet that goes hand in hand with emerging technologies such as blockchain, smart contracts, cryptocurrencies, artificial intelligence, and machine learning.

You can get into this Web 3.0 by investing in a selection of top-notch projects that we will discuss shortly.

What are Web 3.0 cryptocurrencies?

The next generation of the Internet will come with Web 3.0. This will take things to the next level, with a strong focus on emerging technologies such as:

- Blockchain.

- Smart contracts.

- Cryptocurrencies.

- Decentralization.

- Artificial Intelligence.

- Automatic learning.

Web 3.0 will be made up of all of the above technologies and phenomena. And, if you want to invest in the broader growth of this industry, you can buy Web 3.0 cryptocurrencies like the ones we will discuss below, as they will be at the heart of the Web 3.0 ecosystem.

The top 10 cryptocurrencies with a strong connection to Web 3.0 are the following:

1. Tamadoge

One of the most interesting projects that are still in the pre-sale phase is Tamadoge. An ecosystem with a roadmap that bets on longevity with the development of the Metaverse, NFTs, and augmented reality applications.

Its utility token is the TAMA, used in the platform to grant rewards and move the project, this token works under the ERC-20 protocol over the Ethereum network and is characterized by being deflationary.

The game consists of minting Tamadoge pets as baby NFTs, once they grow up they will be able to fight to earn points and finally be rewarded with TAMA on a monthly and recurring basis.

2. Battle Infinity

Battle Infinity is a decentralized project that provides users and creators with the Battle Arena space, a metaverse platform that has deployed 6 different P2E games that users can participate in and players can purchase virtual terrain plots structured as NFTs in games.

P2E with IBAT. At the center of Battle Infinity is IBAT, the platform’s utility token. Which are built on Binance Smart Chains (BSC) and work as a BEP-20 protocol.

The tokens act as in-game rewards for participants, and can also be wagered in global liquidity pools in exchange for other cryptocurrencies.

3. Ethereum

Ethereum belongs to the best accessible Web 3.0 projects. The reason is that Ethereum is at the heart of the Web 3.0 ecosystem as we know it today.

Another fundamental aspect of the Ethereum ecosystem is that it enables anyone, including Web 3.0 projects, to produce and deploy smart contracts.

Furthermore, Ethereum, which was first launched in 2015, is one of the best-performing cryptocurrencies in recent years. For example, in a period of 5 years, the cost of Ethereum has increased by almost 5,000%.

4. Uniswap

A term you constantly come across when searching for the best Web 3.0 cryptocurrencies to trade is “decentralization.” And, in the Uniswap situation, this top-notch plan is at the heart of the decentralized business.

This is because the Uniswap platform which is built on top of the Ethereum blockchain that we have already talked about makes it possible for people from all over the world to trade and sell cryptocurrencies in a decentralized way.

5. Basic Attention Token

Currently, marketing agencies pay websites to display their ads, but none of that revenue reaches those who view the right material and this is where Basic Attention Token aims to change the status quo.

From the perspective of digital marketing agencies, the Basic Attention Token ensures that advertising funds are used correctly. You can benefit from the Basic Attention Token increase by buying its BAT cryptocurrency.

6. Decentraland

The Metaverse is to build a bridge between the digital world and the real world through virtual reality. At the forefront of this is Decentraland, one of the top coins in the metaverse, hosting a hugely successful game world that allows users to invest in digital plots.

Most importantly, several real estate projects in the Decentraland ecosystem have sold for millions of dollars, which shows that this Web 3.0 ecosystem already has a criteria test.

MANA, which is the native token of the Decentraland ecosystem, is one of the top Web 3.0 blockchain coins in terms of performance.

7. Yearn.finance

Yearn. finance plays a role in the future of Web 3.0 with its decentralized lending protocol.

Since Yearn. finance makes it possible to facilitate loans without jurisdictional limitations or credit checks in a decentralized way. This would be because users can borrow cryptocurrencies in exchange for placing collateral. The person will then pay the interest on the borrowed funds.

For example, by depositing your digital currencies on the Yearn. finance platform, the funds will be used to facilitate the loans.

8. Cosmos

Cosmos has an innovative plan that solves the current “blockchain interoperability” problem.

For those of you who don’t know, interoperability has to do with the ability of different blockchains to connect and communicate with each other, which ordinarily might not be feasible.

And as such, each of the best cryptocurrencies on the market can communicate with all the respective blockchain networks through Cosmos.

The project has its native digital token, ATOM, which you can easily trade.

9. The Graph

Blockchain protocols facilitate a significant portion of transactions, which, in parallel, can offer room for efficiency issues for the respective network.

The good news is that Graph is already doing some work on this with its creative blockchain indexing tool, so once blockchains connect to the Graph protocol, their data is automatically indexed.

From an investment perspective, you can benefit from the growth of the Graph and its indexing tool by buying GRT tokens. In short, any blockchain network that uses the tool will have to pay fees in GRT, which in parallel can help its market cost.

10. Tron

This plan originating in China could play a fundamental role in the future of Web 3.0, among other things since it returns the content to its rightful owner: the author.

This means giving up a significant part of the revenue that the respective content creates.

This is where Tron comes in, as the plan allows creators to market their content directly to the public. And as such, most, if not all, of the advertising revenue generated by the content will be paid to the author.

What will be the price of these Web3 cryptocurrencies?

The cost of Web 3.0 cryptocurrencies will be defined by the market, just like the classic activities of Web 1.0 and 2.0 spaces. As such, the cost of the Web 3.0 cryptocurrencies you buy will largely depend on demand and supply.

Where can I buy Web 3.0 cryptocurrency?

Many of these cryptocurrencies can already be found in various exchanges, so all that remains is to choose the one that best suits your tastes. Some of the projects you can even get from their website.

In the same way, the platform you choose should not only be compatible with your Web 3.0 cryptocurrency selections, but it should offer low commissions and a safe place to trade.

Conclusion

The Web 3.0 ecosystem is still quite fragmented, so it might be worth waiting until we have a clearer picture of how this space will progress in the coming years.

These promising Web 3.0 cryptocurrencies are managing to surprise the entire planet throughout their pre-sale, so it only remains to see how this new website is entering and adjusting to the world.

Cryptocurrencies and NFTs have updates practically every day, plus their market is volatile, it can change from one hour to the next so there is always a constant conversation generated from them.

Also, companies are always coming up with new ways in which cryptocurrencies can be applied to new types of businesses or generating collaborations with brands that attract too much attention.

This is why we bring you some of the best sites and blogs to be able to keep you up to date in this fast-changing space.

Next, we have:

CoinTelegraph

It is always up to date and has interesting and informative topics on everything related to cryptocurrencies and blockchain.

NFT Lately

This page mainly focuses on the latest relevant news with new collection releases and all the events in the NFT world.

Bitcoin.com

Focused on giving us the latest details about bitcoin, but also comes out with the latest news on important topics about this world and the blockchain.

Forbes

A magazine dedicated to sharing various topics of technology, finance, and both other topics of the last moment.

One of the characteristics of their notes and why it is worth reading them is that they share tips and strategies on finance, especially with cryptocurrencies.

CoinDesk

Like Forbes, in CoinDesk publishes a lot of news on different topics most of them about technology and business, but the vast majority are about the most relevant news about the crypto world and its education.

They also upload content of opinion articles and interviews aligned on a substantial front page, as well as a podcast.

CryptoNews

Whenever something new comes out regarding the crypto world, you are sure to find it here first. They also share tips on how to move through this world.

Bitcolumnista

Known for their popular blockchain guide. What is the most attention-grabbing is that they allow their community to choose content with a downvote/upvote system ensuring that the first thing you see is quality content.

CoinMarketCap

This site is primarily used for market analysis including price charts, market cap, and trading volumes. You can also get, but they also share news about new coins and ICOs.

Criptodiario

This site mainly publishes news about popular coins such as Bitcoin and Ethereum.

As well as NFT-related content and the latest news from the metaverse.

The Blue Manakin

Here at The Blue Manakin we have our cryptocurrency blogs, focused on answering the questions we usually have when we start getting into this vast world. You can also find news about what is going on in the world of cryptocurrencies and NFT.

We hope these pages are of interest to you and help you to always stay educated and updated about this changing world.

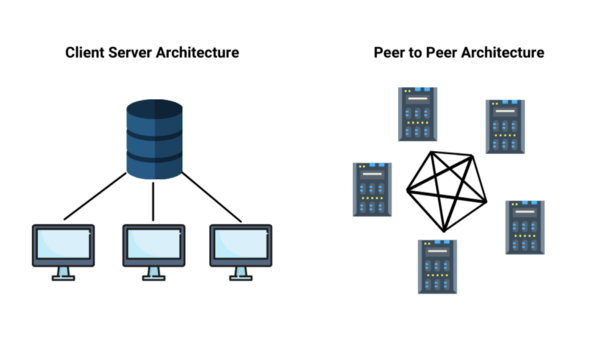

dApps are a type of application that is based on a decentralized network because the nodes that interact with the application are used as several servers instead of a central one.

DApps is the acronym for Decentralized Applications. Decentralized networks work with a network of computers in which users have full control over the operation of the network.

DApps allow people to access different services securely without worrying about being tracked in any way. These applications can use as nodes computers, and smartphones, or can even be accessible from the web.

To taste what a dApp looks like, we must think of an ordinary application, in this category we have applications such as YouTube, Facebook, Twitter, and even Instagram. In all these services there is a network of central servers. This allows companies to decide what can be seen or not in these applications according to them to give it more “security” by taking neutrality.

The dApp concept is nothing new because there have been several over time, but the most popular applications have been BitTorrent and DC++, both with peer-to-peer systems to share files without worrying about censorship because there is no way to track the server.

However, the quintessential dApp that describes exactly how they work on a blockchain is Bitcoin because how its users and structure assign perfectly describes the function of dApps.

But with the arrival of Ethereum in 2014, the Solidity language and the ability to create Smart Contracts made dApps massive, so thanks to these 3 things dApps started to become popular in the blockchain, allowing new ways of interaction between users, the real and virtual world.

The dApps and traditional Apps have many elements in common, however, the difference lies in how they interact with those elements. Both types of applications have three basic structures: the frontend, the backend, and the data storage layer.

It is believed that almost a third of the bitcoins in circulation remain lost in a kind of virtual limbo, of people who in the early days of bitcoin bought and now that it had its price increase, do not remember the passwords to their wallets. The data was published in the Wall Street Journal and shared by Chainalysis.

In the data, it is found that between 17% and 23% of existing bitcoins are inoperative or forgotten on the Blockchain.

These estimates are based on a study on the blockchain where all bitcoin records are stored. According to their calculations, there may be between 2.78 and 3.79 million bitcoins lost in the network.

The figures refer to those that have been lost and for the moment have no possibility of being used. Those that were hacked or stolen, are not taken into account as they are still in control of the coins.

The results are shown below:

- 30 and 50% are out of circulation

- 100% original coins

- 2% in sales and purchase

- 2% strategic investors